———— Release time:2021-01-14 Edit: Read:31 ————

There are two main logics of capital allocation:

1. Profit

2. Security

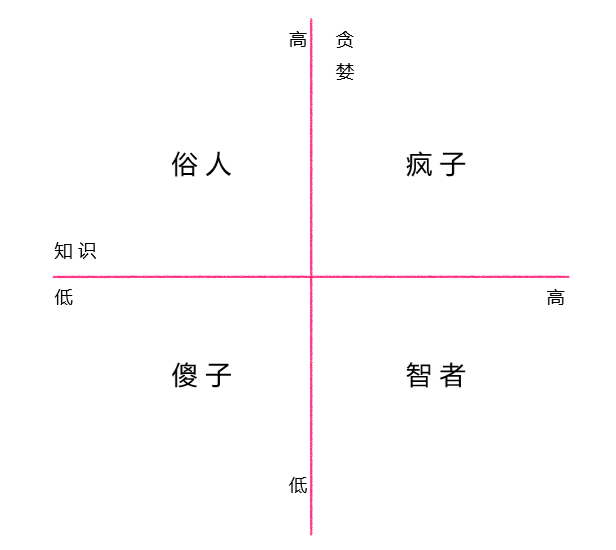

The reason for putting profit first is that the laity (representing the ignorant and greedy) and the lunatic (representing the knowledgeable and radical) think so, while the fool (representing the ignorant and timid) and the wise (representing the knowledgeable and conservatives) don't think so.

In the world of lay people, the judgment of knowledge is wrong, and the judgment of safety is also wrong. In their eyes, benefits are the first to see. Four words floated from the sky: Do it and it's over.

Crazy people know what is right and wrong and what is risk, and they dare to make money with laymen and fools.

The fool's eyes are full of hostility towards the world, but it's not that I don't understand how fast the world changes. When the interests were before us, two words came out: liar.

Wise men use knowledge to measure risk, have a degree of offense and defense, and have long-term thinking. The benefits are before the eyes. First consider two words: alive (an slogan of Inamori's old man). When you are alive, you have to look at the five words in the sky: risk-return ratio.

-176bc6e1-c88d-435b-86ce-aa2e35b6fe49.png)

The epidemic has developed into a global test. Compared with previous events such as economic crises and geo-risk events, the biggest aspect of this epidemic is: fairness, notarization, and openness.

Under the three commonwealths, the wise men in the world also appraise papers through the two dimensions of safety and profitability.

To be honest, if the United States as a teacher asks questions for the world, it is indeed very tricky, and there are many traps that make people make mistakes. What happens when the United States, as a student, and other countries do a set of test papers that no country has ever done?

The results are gradually coming out. China's performance seems to be the best. South Korea, Japan, Australia, Europe, Iran, Arabia, Pakistan, and Argentina, regardless of their political system or body, performed poorly.

In terms of security, in major international security incidents, it seems that only China is capable of local control across the country. Of course, Taiwan and Hong Kong belong to the observation period. If Taiwan and Hong Kong are not naughty, mainland China will help them make up lessons. If Taiwan and Hong Kong are too naughty, China will include them, and they will be punished to stand in the corner and face the wall.

Even if the epidemic is over and the same test paper is taken again, can other countries still be able to do better than their results this time? China raised its hands confidently. Even if other students raise their hands, do you believe it?

Security is the key consideration for the wise. Because the wise man needs to rest for a long time, otherwise the decision cost is too high.

The wise man then considers profitability.

Asset allocation in a country includes stocks, equity, debt, fixed assets, and currency assets.

Analyze China's internal situation one by one.

Stocks: Globally, Chinese stocks are low-value assets. A low valuation means a high margin of safety. This is the first step of the wise investment decision, passed. The rest is the issue of where the ceiling is, that is, the issue of profit-risk ratio.

Equity: China is reforming, from the old three to the new three, but the new three has not yet decided what it is. There are 5 or even 8 in the candidate list waiting. China is taking turns to test, so there are all kinds of opportunities in it, there are opportunities for one industry, and even continuous rotation. There are so many opportunities, one cannot try another. Anyway, there are policies, and all walks of life have the possibility to make their heads. The market has the allure, and if there is more temptation, people will be greedy, and even fools will want to return to the vulgar (about to move, this word is used here in a special image: stupid, still want to move. This sentence, "words the rationale is not rough rough"). Some smart people even want to go crazy. If the market evolves in this way, there will be two words floating in the sky this time: prosperity.

Of course, it is not about prosperity now, but that if the wheels turn, it will create a scene of prosperity.

If there is prosperity, how will the creditor's rights develop? We all know that in the prosperous era of China's real estate industry, what do real estate companies rely on to keep their wheels going? Prosperity expectations bring confidence, and confidence brings prosperity to the debt market.

What do companies do with money from debt financing? In the past, there were many houses, because houses had the highest profit-to-risk ratio. If after China's reforms, other industries become the new three, then the assets of these industries will also become tools for absorbing financing. Financing will be used for industry expansion, that is, high-quality asset investment in the industry.

The remaining one is a monetary asset. If global investors like to invest in China, Chinese currency will be needed. Strong demand means strong currency. Adjustments on the supply side will not be discussed in this article.

Looking back on all this prosperity a few years later, it was actually caused by a bat...

-677bb495-47de-4fa4-9b47-c6488138178e.png)

Author:Lin Lehui, Senior Research Fellow of INERI, Doctor of Economics, Dongbei University of Finance and Economics, Bachelor and Master of Computer Science, Harbin Institute of Technology. e goods at business cycle research, financial transactions, family wealth management. His previous post: Senior Manager of Nasdaq listed company. His current position: Director of quantitative research of private equity funds, fund manager