———— Release time:2021-01-14 Edit: Read:26 ————

Today, many friends who are concerned about economic activities may have noticed news related to oil prices:

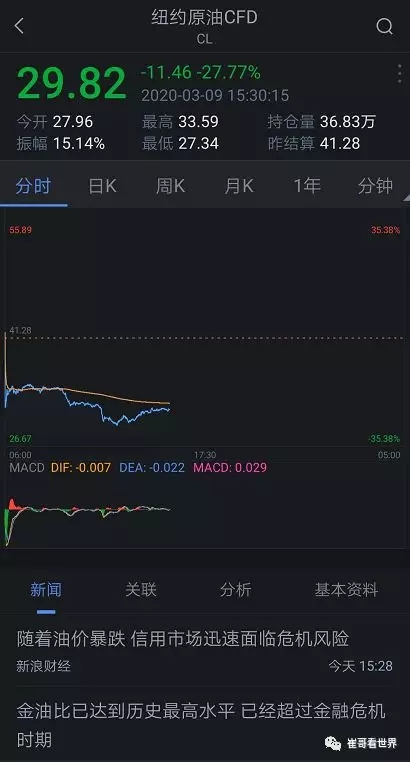

Why did crude oil prices fall in a cascading manner?

The spread of the epidemic has led to a sharp decline in global economic activities, and the demand for crude oil has fallen rapidly, resulting in an oversupply situation. Last Friday, OPEC, headed by Saudi Arabia, conducted a new round of production cut negotiations with Russia, trying to maintain prices through production cuts, but the negotiations broke down.

Everyone is unwilling to reduce production, hoping to maintain their market share. This is a typical "prisoner's dilemma." Therefore, Saudi Arabia is the first to strike first. Saudi Arabia immediately launched an all-out oil price war and drastically lowered the prices of major crude oils of different levels. The cut has reached the largest reduction in 20 years, which means it will increase production and seize the market(Production is likely to increase from 9.7 million barrels per day to a record high of 12 million barrels per day next month).

This situation occurred in 1985 and 1997, and it was also initiated by Saudi Arabia. The only difference is that there was no COVID-19 epidemic at that time. The epidemic is still raging around the world, further increasing market uncertainty. (In 1985, after several years of OPEC production cuts, Saudi Arabia abandoned production cuts and launched a price war. Between November 1985 and May 1986, oil prices plummeted by nearly 70%.

In 1997, Venezuela’s overproduction made Saudi Arabia intolerable, and Saudi Arabia once again crashed the market.

In the next year and a half, oil prices fell by 50%. By December 1998, Brent oil fell to its lowest level in history, at 9.55 US dollars per barrel.)

Why can Saudi Arabia frequently launch such price-cutting attacks?

Because Saudi Arabia has huge crude oil reserves, and still dominated by spouting wells (that is, without gas flooding, water flooding, fracturing, etc.), production costs are extremely low. Some experts estimate that its cost is basically between 5-8 US dollars per barrel. Moreover, the production facilities are complete, and the rate of increase in production is very fast.

How does the fall in crude oil prices affect our daily life?

Since January, the epidemic has led to a shortage of supplies of various living materials (stopping work and production), and prices have risen across the board. At this moment, if the decline in crude oil is transmitted to the country, it will reduce inflationary pressure to a certain extent and reduce the cost of the entire society, including fuel, plastics, packaging, fertilizer, food, clothing, transportation, and so on.

Yes, almost all of our daily necessities and consumption today are more or less closely related to chemical production.

Of course, companies engaged in related trade and even futures trading may suffer huge losses. This is also the reason why hedging and risk hedging are promoted in energy trading (or commodity trading).