———— Release time:2021-01-14 Edit: Read:25 ————

Editor's note

Regarding the strong performance of cement stocks, Dr.Zheng Lei, Deputy Dean of INER who was interviewed by a reporter from Securities Daily, said that the sector benefited from the logic of internal circulation, and infrastructure investment was the main driving force. When I forecasted the whole year in January, I determined that economic policies would definitely be tilted towards infrastructure-related fields. The rise in cement and building materials has also started since the beginning of the year, and has passed two peaks, and the index hit a new high on Thursday. I suggest that investors pay attention to cement and building materials in key areas of infrastructure construction, but they should pay attention to possible callback in the near future.

On Thursday, Shanghai and Shenzhen Stock Market oscillated after Wednesday’s surge. The cement and building materials sector has sprung up, rising rapidly within 5 minutes of opening, which sets a new high in the index of Oriental Fortune sector this year and became the leading sector. As of Thursday's close, the sector index rose by 2.07%, ranking first among industry sectors.

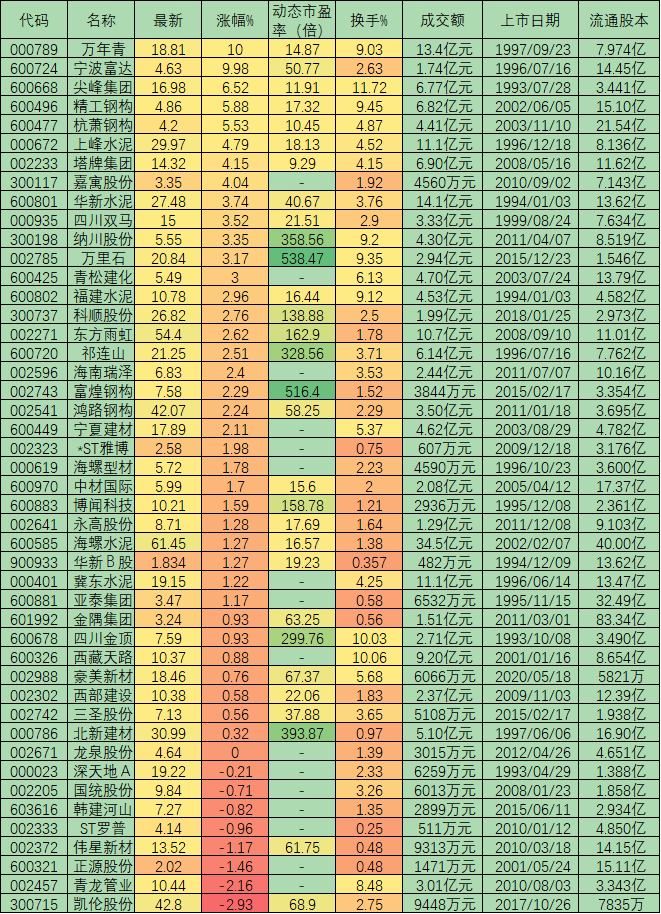

In terms of specific market performance, 37 of the 46 cement and building materials stocks that traded on Thursday realized gains. Among them, 13 stocks, including Wannianqing (10%), Ningbo Fuda (9.98%), and Jianfeng Group (6.52%), all rose more than 3%.

Regarding the strong performance of cement stocks, Dr.Zheng Lei, Deputy Dean of INER who was interviewed by a reporter from Securities Daily, said that the sector benefited from the logic of internal circulation, and infrastructure investment was the main driving force. When I forecasted the whole year in January, I determined that economic policies would definitely be tilted towards infrastructure-related fields. The rise in cement and building materials has also started since the beginning of the year, and has passed two peaks, and the index hit a new high on Thursday. I suggest that investors pay attention to cement and building materials in key areas of infrastructure construction, but they should pay attention to possible corrections in the near future.

Liu Youhua, a Senior Research Fellow at Shenzhen PaiPaiWang Investment and management Co. Ltd, told the "Securities Daily" reporter that three reasons have contributed to the continued strength of the cement and building materials sector. The first is that the price remains at a high level during the same period in history, and there are still expectations of price increases. Secondly, with the end of the domestic flood season and the start of various infrastructure projects across the country, market demand is expected to pick up significantly. Finally, from the domestic data in the first half of the year, the infrastructure industry was minimally affected by the epidemic. Under the stimulus of various economic policies, the growth rate of investment in the infrastructure sector has increased significantly year-on-year. In the next year, the prosperity of the cement and building materials industry is expected to continue to remain high, and the stock prices of industry leading stocks are also expected to go out of trend.

From the analysis of industry insiders, it can be found that the market has high certainty expectations for the performance of cement building materials companies. Judging from the 2020 mid-year report performance forecast, the cement and building materials sector performed well. The data shows that that among the 30 companies that have disclosed their performance forecasts, 16 companies have a pre-happy performance, accounting for 53.33%. Among them, Almaden, BNBM, Hainan Development, Sichuan Jinding and other four companies are expected to double the net profit year-on-year.

From the perspective of institutional holdings, even though public funds undertook certain reductions in the sector in the second quarter of this year, some stocks still gained hold. From the perspective of individual stock holdings, Yonggao shares, Qilianshan, Mona Lisa, Leizhi Group, Asia Chuangneng, etc. are the main increase targets for public funds. The growth rate of public fund holdings exceeded 150%.

Regarding the investment strategy of cement and building materials stocks, Tianfeng Securities provides a layout route in three major areas. 1. Consumer building materials: continue to recommend D&O Home Collection , Mona Lisa, Jiangshan Oupai, Oriental Yuhong, Keshun, Asia Cuanon, Sankeshu, Yonggao, etc.; 2. Cement sector: The leading stocks in the sector can focus on Conch Cement, the core asset of the cycle. From a regional perspective, the Northwest (Gansu, Xinjiang) and Jiangxi markets are recommended. The regional prosperity exceeded market expectations. In terms of combination, we recommend Conch Cement + Qilian Mountain, focusing on Evergreen. 3. For glass/glass fiber: It is recommended to pay attention to Kibing Group, China Jushi and Sinoma Technology.

Table: List of market performance of cement and building materials stocks on Thursday

This article is reproduced from "Securities Daily Net"